COVID-19 Whistleblower Cases Against Nursing Homes

In Maryland and around the country, nursing homes and long-term care facilities have become major coronavirus hotspots. Over 60% of Maryland’s COVID-19 deaths have occurred in nursing homes. The deadly impact of COVID-19 on nursing home residents is not only due to the fact that the elderly are more vulnerable to the virus. There is now a growing understanding that the coronavirus is sweeping through nursing homes because of negligent care and failure to follow proper safeguards.

The federal False Claims Act (FCA) may provide us with the ability to hold nursing homes accountable for failing to protect residents from COVID-19. Nursing homes are required to follow very strict CDC protocol for infection prevention and control of infections like COVID-19. If a nursing home knowingly fails to follow these safety standards they are defrauding Medicare by accepting payments while falsely claiming to be in compliance with federal rules and regulations. Anyone with knowledge of this type of fraud can bring a whistleblower lawsuit under the FCA. If the suit is successful, the whistleblower can be entitled to a large percentage of any money recovered.

Nursing Home Whistleblower Lawsuits Under the FCA

The FCA is a law that basically prohibits companies from making false statements in order to receive payment from the federal government. The FCA allows individuals (usually company employees) with knowledge of fraudulent activity to become “whistleblowers” and bring suit on behalf of the government. If the whistleblower lawsuit is successful, the whistleblower can get a significant amount of money. Up to 30% of any money awarded in the case.

In the past, whistleblower lawsuits against nursing homes have not been very common. However, the Department of Justice is now actively encouraging people to blow the whistle on nursing homes and bring FCA lawsuits against them. Nursing home fraud cases related to the coronavirus pandemic will likely fall into 2 main categories: (1) false certification; and (2) fraudulent billing.

(1) False Certification

In a false certification case under the FCA, the nursing home is sued for accepting Medicare payments while providing substandard care in violation of applicable regulations. Nursing home fraud cases under the FCA involving substandard care are not new. However, these types of whistleblower cases are likely going to become much more common and involve much higher stakes in the wake of COVID-19. Here is a basic outline of how a nursing home can get sued in a whistleblower action for fraud based on substandard care.

All nursing homes and assisted living facilities receive payments from Medicare. In fact, Medicare reimbursement payments account for a major portion of revenues for most nursing home facilities. This means that nursing homes can be liable under the FCA if they make false representations in order to receive Medicare payments. All Medicare approved nursing homes are required to comply with regulations and rules regarding patient care and safety. If they fail to comply, they can potentially lose their approved status and no longer be eligible for Medicare payments.

Each time a nursing home requests reimbursement from Medicare, the facility must certify that it is in compliance with the rules and regulations regarding patient care and safety. If the nursing home is blatantly ignoring patient care regulations, but certifying to Medicare that they are in compliance to receive payment, that is fraud. The nursing home is making a false claim for the purpose of receiving money from the federal government. This is exactly the type of fraudulent conduct that whistleblower lawsuit under the FCA can be based on.

Historically, false claims act lawsuits against nursing homes for substandard care have infrequent. This is mainly because before COVID-19 the consequences of a nursing home failing to comply with patient care regulations were not very drastic. The coronavirus has changed this very dramatically. Now if a nursing home provides substandard care, half of its residents might get COVID-19 and die.

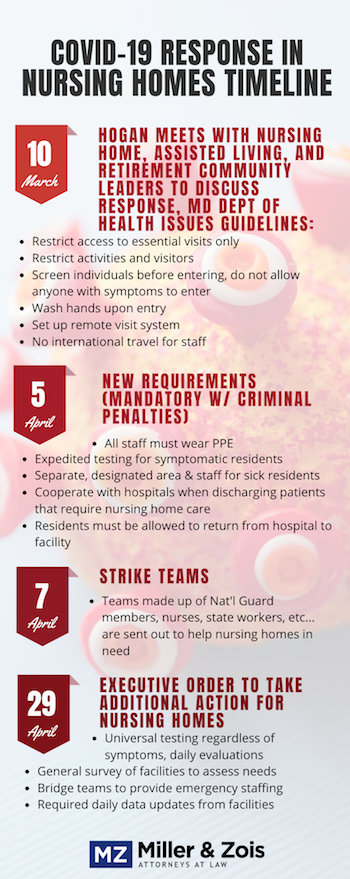

In order for substandard care at a nursing home to give rise to a false claims act lawsuit, it needs to be systemic and widespread. A few isolated incidents of negligent care are not enough to support a false claims act lawsuit. There also needs to be a direct violation of federal patient care and safety regulations. In response to COVID-19, the federal government has enacted new coronavirus safety protocol that nursing homes must follow to keep residents safe. Some of the directives in these new COVID-19 safety regulations include:

- Restricting visitation to only essential health care personnel

- Mandatory use of personal protective equipment

- Cancellation of group dining and activities

- Strict isolation of infected residents

- Screening for respiratory symptoms

Failure to comply with 1 or 2 of these directives is probably not enough for a false claims act lawsuit. Isolated or temporary incidents of non-compliance are also not enough. However, if a nursing home has systematically failed to comply with many of the COVID-19 safety regulations for a prolonged time, that would definitely warrant a whistleblower lawsuit under the FCA. This would be particularly true if the nursing home failed to comply with the regulations and then got hit hard by COVID-19.

Example Case:

Lets say there are 2 nursing homes in one town: Home A and Home B. Both nursing homes have similar facilities and resident populations. Home A fully and carefully complies with all of the CDC guidelines and the federal COVID-19 regulations regarding patient safety. Home A doesn’t get hit very hard and only has 1 COVID-1 death and a dozen cases. Home B, however, is woefully understaffed. As a result they are not able to comply with many of the new COVID-19 regulations. Home B continues group dining and fails to screen and isolate residents with symptoms. Home B ends up becoming a COVID-19 hotspot with 20 deaths and hundreds of positive cases. If a staff member at Home B comes forward with evidence of this non-compliance, they can bring a whistleblower action on behalf of Medicare.

Our firm is currently seeking for whistleblowers to come forward in false certification FCA cases against nursing homes.

(b) Fraudulent Billing

The other type of nursing home fraud that can be grounds for a whistleblower lawsuit under the False Claims Act is fraudulent Medicare billing. Medicare and Medcaid have very strict rules for what nursing homes are entitled to get reimbursement for. If a nursing home deliberately breaks these rules or makes misrepresentations in order to get improper Medicare payments they can be liable under the FCA. Here are some of the most common fraudulent Medicare billing schemes at nursing homes:

- Phantom Billing: this occurs when the nursing home bills Medicare for patient care or services that were never actually performed or for “phantom” patients.

- Double Billing or Upbilling: this type of fraud occurs when the nursing home bills Medicare for services, procedures or supplies that were more expensive or those actually performed.

- Medically Unnecessary Billing: where the nursi

ng home performs medical procedures or treatment that is not medically necessary and then bills Medicare. - Non-Eligible: misrepresenting that a patient is eligible for Medicare reimbursable services.

In response to COVID-19, the federal government enacted new laws which increased the amount payments nursing homes could receive for any services or treatments that were related to COVID-19. This will likely lead to a new type of COVID-19 billing fraud in which the nursing home falsely classifies treatments as COVID-19 related to get the increased payment amount.

Who Can Be A Nursing Home Whistleblower?

A whistleblower in a False Claims Act case involving nursing home fraud can theoretically be anyone with direct knowledge of fraudulent conduct at the facility. In most cases the whistleblower will be a current or former employee at the nursing home facility. Employees are the most effective whistleblower plaintiffs because they have direct, inside information and knowledge of the alleged fraud.

You do not need to be an employee of the nursing home to file a whistleblower lawsuit. Non-employees can also be whistleblowers if they have direct knowledge of fraud at the nursing home. The whistleblower in a false certification case based on substandard COVID-19 care can be child or family member of a resident who has become aware of unsafe practices at the facility.

Can I Sue a Nursing Home for Failing to Protect Patients from COVID-19?

If you have direct evidence or inside knowledge that a nursing home knowingly failed to comply with federal safety regulations regarding COVID-19, you may be able to become a whistleblower plaintiff and file a False Claim Act case against the nursing home.

Can I Get Money for Being a Whistleblower Plaintiff?

If a whistleblower plaintiff files a lawsuit under the False Claims Act for COVID-19 fraud or inadequate patient care, the whistleblower may be entitled to keep up to 30% of any money awarded in the case.

Contact Miller & Zois About Becoming A Nursing Home Whistleblower

If you are aware of fraud or violations of safety regulations at a nursing home, particularly in connection with COVID-19, you may be able to bring a whistleblower lawsuit against the nursing home. Contact our office today to see if you have a valid case. If you become a FCA whistleblower and the lawsuit is successful, you can receive up to 30% of any money awarded in the case.

- Coronavirus legal resource center

- Nursing home COVID-19 malpractice claims

- Wage and hour claims against nursing homes

Maryland Personal Injury Lawyers

Maryland Personal Injury Lawyers